In the year 2015, Aegon Life was awarded as the ‘E-Business Leader’ at the Indian Insurance Awards for the third year running, under the category of Overall Insurance Industry Awards.

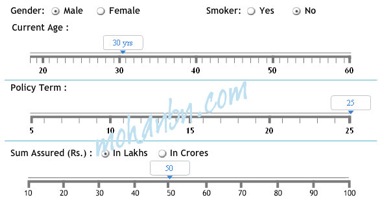

25 of the sum assured will be paid on diagnosis of terminal illness and subsequently the sum assured will be reduced by that amount. iTerm comes with an add-in terminal illness cover for no extra cost. Along with that, it has been upbeat with its product development. As per the terms, conditions and features, benefits payable (if any) on non-payment of premiums or when policy lapses will vary. Premiums are as low as about Rs.4,050 of annual premium for Rs 50 lakh of cover if you are 30 years of age and in good health. The features are as follows: If the insured dies, the nominee will receive Rs.10, 000 per month for 10 years. Aviva Life Insurance thus enjoys a healthy market share and has different types of life insurance products to cater the needs of its clients.Īegon Religare Insurance plans are focused on giving the customer with best means to meet their long-term Financial goals. Monthly premiumAnnualised premium 0.087 Aegon Life Easy Protect Insurance Plan A plan which can be bought without any requirement of medical tests. On the other side, Bennett, Colman & Company is India’s major media conglomerate. Aegon Religare Life Insurance has adopted a local approach and has empowered it with the power of global expertise.Īegon’s history dates back to 170 years and it has steadily grown into an international powerhouse with business in over 20 countries across the globe. After the lump sum payment on death, the monthly payment of 1.75 of Sum Assured for a period of 60 months commencing from next monthly policy anniversary is. This venture aims to build a customer-centric business structure and provide an excellent and innovative work experience. Flexibility : Aegon Life Term plans offer you the flexibility to select policy terms and premium payment terms as per your need. It is a joint endeavour between Aegon and Bennett, Coleman & Company. In Indian insurance Market, Aegon Life Insurance (Previously known as Aegon Religare Life Insurance Company Limited) was launched in 2008.

It is a short premium paying term plan that allows customers to enhance savings”ĪEGON Religare became a pioneer in the life insurance online space by launching India’s first online term plan. It is an ideal plan for a medium-term investor who needs the security of growth, without undue risk. iGuarantee offers guaranteed returns for a period of six years, after the policy term. The nominee also has an option to take the cash value of the death benefit at any point during the policy term.Īt the launch Executive Director of AEGON Religare KS Gopalakrishnan said, “We pioneered the online space in life insurance and we would like to maintain our leadership position by offering an expanded suite of products. The nominee receives the guaranteed payouts, as scheduled. Inbuilt accidental death benefit: if there is an accidental death, extra accidental benefit equal to 100 of the sum assured will be offered to the customer, subject to a maximum of Rs.1 crore. If the policyholder dies then the future premiums under this policy are waived. Aegon Life Term Plan Features and Benefits: Life cover: customers can avail life cover up the age of 75 years. Guaranteed death benefit of SA = 10x Annualized premium Guaranteed returns on maturity - 135% returns on annualized premium paid Some of the USPs of the plan are as follows: AEGON Religare iGuarantee Insurance plans is a savings plan which offers guaranteed returns. After tasting success with iTerm and iMaximize, AEGON Religare Life Insurance (ARLI) has launched another online insurance plan called iGuarantee Insurance Plan.

0 kommentar(er)

0 kommentar(er)